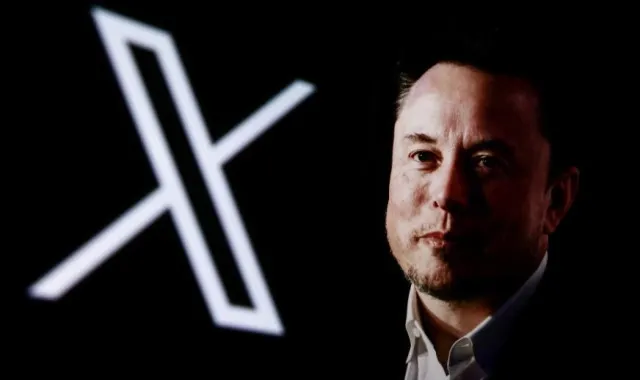

The US has filed a lawsuit against Elon Musk, claiming he underpaid Twitter by at least $150 million during the acquisition.

Elon Musk, the well-known CEO of Tesla and SpaceX, is facing a lawsuit from the U.S. Securities and Exchange Commission (SEC).

This legal action comes after claims that he underpaid for Twitter, now called X, by at least $150 million.

The lawsuit focuses on Musk’s purchase of Twitter, which he bought for $44 billion in October 2022.

Musk’s Twitter purchase was highly publicized and significant.

Musk’s acquisition of Twitter was highly publicized and marked a significant event in the tech world.

He had been vocal about his intentions to make changes to the platform.

However, the SEC claims that Musk failed to follow the rules regarding the disclosure of his ownership stake in the company.

Specifically, they allege that he did not reveal his ownership of more than 5% of Twitter’s common stock in a timely manner.

The SEC accuses Elon Musk of manipulating Twitter’s stock prices.

According to the SEC, Musk’s delay in reporting his stock ownership allowed him to buy shares at lower prices.

The filing states that this resulted in him underpaying for the shares he purchased after he was supposed to report his ownership.

The SEC claims Musk’s actions harmed shareholders by allowing him to buy shares from sellers unaware of his growing interest.

When Musk finally disclosed that he owned 9% of Twitter, the stock price increased significantly.

This rise in share price sparked complaints from other investors who felt they were at a disadvantage due to Musk’s actions.

The SEC argues that Musk’s behavior was manipulative and unfair to other shareholders.

Elon Musk has denied the allegations made by the SEC.

His lawyer, Alex Spiro, stated that the lawsuit lacks merit and claims it is an attempt to harass Musk.

Spiro argues that Musk has done nothing wrong and that the SEC is simply trying to make a case where there is none.

He referred to the lawsuit as a “ticky-tack complaint” over a minor issue involving a single form that was not filed on time.

Musk has not been a stranger to legal troubles in the past.

In 2021, the SEC investigated him and his brother, Kimbal Musk, for potential securities fraud related to their sale of Tesla shares.

The SEC stands firm in its lawsuit against Musk.

They believe it is essential to hold high-profile figures accountable for their actions in the financial market.

The agency emphasizes the importance of market transparency and fair practices for all investors, regardless of their status.

An SEC spokesperson declined to comment further, stating that the lawsuit itself is a matter of public record.

The agency aims to ensure that all market participants follow the rules to protect investors from manipulation.

Implications of the lawsuit

This lawsuit could have significant implications for Musk and his businesses.

As one of the richest individuals in the world, he is no stranger to the spotlight.

However, the mounting legal challenges could impact his reputation and financial standing.

Additionally, this case raises questions about the responsibilities of corporate leaders.

High-profile figures like Musk are often seen as role models, and their actions can influence the behavior of other investors and companies.

The SEC’s efforts to enforce regulations highlight the ongoing challenges in maintaining fairness in the financial markets.