Trump’s DOGE executive order freezes government credit cards, requiring federal workers to justify their expenses and explain their spending.

Former President Donald Trump has recently taken action to freeze all government credit cards.

This decision comes as part of a new executive order issued on February 26, 2025.

The move aims to address concerns about spending and accountability among federal workers.

Concerns over government spending

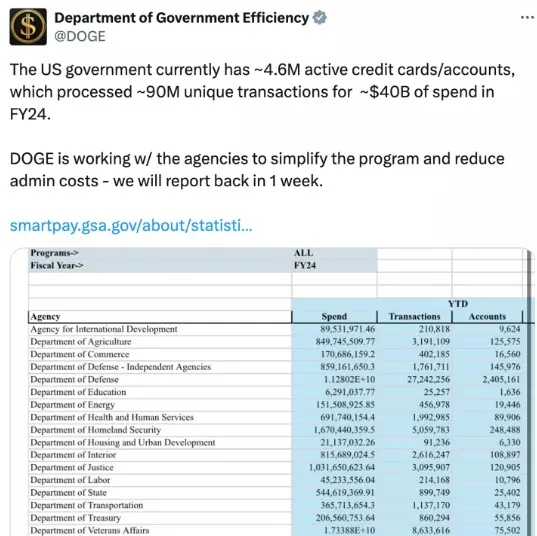

The Department of Government Efficiency (DOGE) reported that credit cards issued to government employees were responsible for $40 billion in spending last year.

This figure raised alarms about how taxpayer money was being used.

In response, Trump’s executive order seeks to implement stricter controls over these expenses.

The order specifies that all government credit cards will be frozen for 30 days.

This temporary measure is designed to give agencies time to evaluate their spending practices.

Certain exceptions apply, including cards used for disaster relief or critical services.

In part, the order reads: “To the maximum extent permitted by law, all credit cards held by agency employees shall be treated as frozen for 30 days from the date of this order.”

Details of the DOGE executive order

The executive order states, “To the maximum extent permitted by law, all credit cards held by agency employees shall be treated as frozen for 30 days from the date of this order.”

Approximately 4.6 million credit cards are affected by this freeze. The order aims to ensure that all expenditures are justified and necessary.

In addition to freezing the cards, the order directs DOGE to develop a centralized system. This system will track every payment made by government agencies.

Federal workers will be required to provide a brief justification for any payments they approve.

Potential impact on federal workers

While the initiative aims to promote accountability, some federal employees are concerned about the freeze.

One employee expressed that this situation could be worse than a government shutdown.

They questioned whether employees would still be expected to travel or use personal cards for work expenses.

The General Services Administration reports that government credit cards are issued across more than 250 federal agencies.

These cards are used to make purchases necessary for each agency’s mission. The freeze could disrupt important operations and services.

They said: “It honestly might be described as basically-a-government-shutdown but worse because of the uncertainty.

Are [federal] employees still supposed to travel? Are they just supposed to use their personal cards and hope they get paid back?”

Reaction to Trump’s DOGE executive order

Reactions to Trump’s executive order have been mixed. Supporters argue that it is a necessary step to curb wasteful spending and increase transparency.

They believe it will help rebuild trust with the American public regarding how government funds are managed.

On the other hand, critics worry about the practical implications of the freeze.

They argue that sudden restrictions on credit card use could hinder agency operations. This could result in delays in essential services and projects.

One user said: CC companies provide a summary of yearly expenses so it could be fairly easy to determine unauthorized spending. It’s just a lot of bills to go through.

The second user wrote: When I had a government credit card for travel, every expense was scrutinized by at least four people above my pay grade before reimbursement was approved.

The third user added: 4.6 million active credit cards for government employees. WOW. Not hard to see why we are 36 trillion in debt.

The fourth user said: It’s been well known for a long time that there is no oversight on government credit card spending.

I’ve seen people reprimanded for bringing this up to their superiors.

Another user commented: Getting over and above charges approved is something the company I do books for just initiated due to misuse, so I can imagine the abuse at governmental level.

Future plans for government spending

As part of the order, the DOGE plans to work closely with federal agencies. The goal is to simplify the credit card program and reduce administrative costs.

By implementing a more transparent process, the administration hopes to enhance the efficiency of government spending.

Trump has emphasized the importance of accountability in federal spending.

He stated that this initiative is part of a broader strategy to transform how the government handles contracts, grants, and loans.

The focus is on making spending transparent and ensuring employees are accountable for their actions.