A man triggered the collapse of an entire bank by selling it a non-existent airport in a deal worth $242 million.

In a bizarre story, a man named Emmanuel Nwude caused the collapse of an entire bank after selling it an imaginary airport for $242 million.

This incredible case of fraud involved deception, high-level banking, and a lot of money.

The man was a director at a bank with full knowledge of how the financial industry worked

Emmanuel Nwude was a director at the Union Bank of Nigeria.

He had a solid understanding of how the banking industry worked, which he used to his advantage.

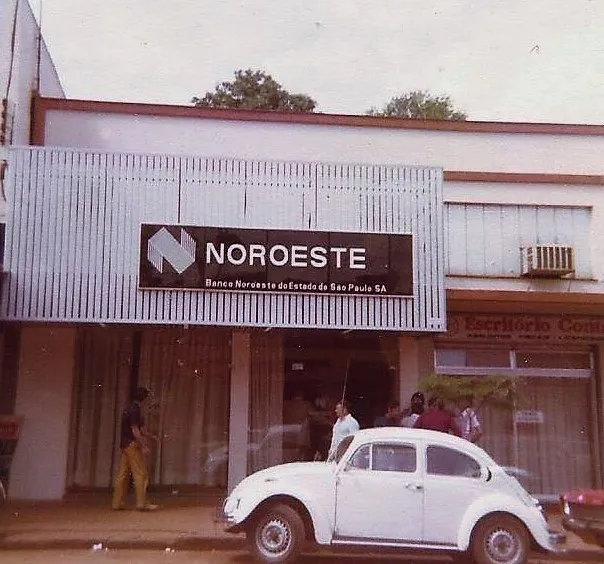

In the mid-1990s, he made a phone call to a director of a Brazilian bank called Banco Noroeste.

However, he pretended to be Paul Ogwuma, the then-governor of the Central Bank of Nigeria, to gain trust.

Man causes entire bank collapse after selling the director a $242M imaginary airport

During the call, Nwude claimed he was developing a new airport and needed funding.

Nelson Sakaguchi, the director at Banco Noroeste, found the potential profit intriguing.

If the project went through, he would earn a $10 million commission.

Lured by the promise of profit and without doing proper background checks, Sakaguchi agreed to the deal.

From 1995 to 1998, Nwude collected a total of $242 million from Banco Noroeste for a project that did not exist.

The bank was so taken in by Nwude’s scheme that they never questioned the legitimacy of the airport.

It wasn’t until 1997, when Banco Noroeste was acquired by the banking giant Santander, that the problems began to surface.

As the acquisition process happened, it became clear that Banco Noroeste had serious financial issues.

They had a significant amount of their funds sitting in the Cayman Islands and were also financing a nonexistent airport.

This discovery led to chaos within the bank, which was unable to recover from the financial damage caused by Nwude’s fraud.

By 2001, Banco Noroeste had completely collapsed.

Authorities’ interference after the bank collapse

Authorities launched investigations to uncover how Nwude managed to defraud the bank of such a massive sum.

The acquisition by Santander went through, but the repercussions for Banco Noroeste were devastating and irreversible.

After the bank’s collapse, authorities began to piece together the details of Nwude’s scheme.

In 2004, authorities brought him and several accomplices to court to face charges.

Initially, the case was thrown out, but Nwude and his associates were arrested again to face new charges in a different court.

The man ultimately sentenced to 25 years in prison

Eventually, Nwude and his co-conspirators pleaded guilty to over 100 counts of fraud and bribery.

Interestingly, before their trial, Nwude attempted to bribe a witness with $75,000 to avoid facing justice. However, this move only landed him in more trouble.

The court sentenced Emmanuel Nwude to 25 years in prison for his role in the fraud.

Despite the severity of his crime, authorities granted him an early release in 2006 after he served just a few years.

His case serves as a cautionary tale about the vulnerabilities in the banking system and the lengths some individuals will go to to commit fraud.