People are posting receipts showing sharp price hikes as Trump’s new tariffs take effect, impacting imports and small businesses.

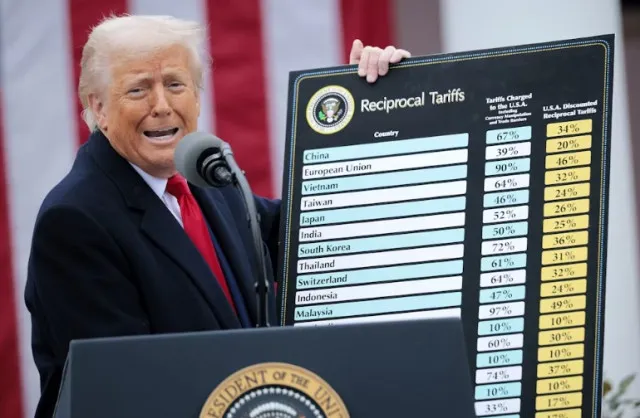

Donald Trump’s recent wave of new tariffs is starting to ripple through the U.S. economy.

Businesses are being hit hard, and consumers are facing higher costs.

From major corporations like Walmart to small tech firms, the financial strain is becoming increasingly visible, and alarming.

In a surprising move, Trump’s tariffs have even targeted imports from remote regions like the Heard Island and McDonald Islands.

These isolated territories are mainly home to penguins and seals.

While symbolic in nature, this decision underscores the sweeping and indiscriminate nature of the new trade policy.

Walmart warns consumers of potential price increases

Retail giant Walmart recently acknowledged the looming impact of these tariffs on its pricing structure.

CEO Douglas McMillon stated that while the company would try to keep prices low, absorbing the added cost fully would not be feasible.

Walmart CEO Douglas McMillon said, “We will do our best to keep our prices as low as possible. But given the magnitude of the tariffs, even at the reduced levels announced this week, we aren’t able to absorb all the pressure given the reality of narrow retail margins.”

Business owners reveal shocking costs as Trump’s tariffs come into effect and hit US imports hard

Smaller businesses have been more vocal in exposing the toll the new tariffs are taking.

Wyze Cam, a home tech company based in Washington, publicly shared documentation showing that it was charged $255,000 in tariffs and nearly $600 in additional fees to import just $167,000 worth of products.

GlytchTech, another tech company, posted a DHL invoice showing over $2,800 in tariffs on imports worth less than $2,000.

These receipts have been widely circulated online, sparking concern among entrepreneurs and consumers alike.

Adafruit Industries shares shocking import tariff bill

Electronics supplier Adafruit Industries joined the growing list of companies speaking out.

In a detailed blog post, the company shared a receipt from DHL highlighting a triple-layered tariff structure, including a 125%, 20%, and 25% markup.

This compounded tax, the company noted, is drastically affecting their ability to manage cash flow.

Tariffs, unlike income or sales taxes, must be paid upfront before a product is sold.

This upfront cost heavily strains small businesses already working with tight budgets.

“Unlike other taxes like sales tax where we collect on behalf of the state and then submit it back at the end of the month, or income taxes, where we only pay if we are profitable, tariff taxes are paid before we sell any of the products and are due within a week of receipt which has a big impact on cash flow.”

Limited supply options worsen tariff burden for firms

Adafruit explained that the products were ordered and manufactured well before the tariffs took effect.

This timing left no opportunity to adjust orders or find alternative suppliers.

Due to intellectual property restrictions, they also cannot manufacture the items themselves or buy them from a different supplier.

The company is considering applying for reclassification to avoid the highest tariffs.

However, they acknowledge that the process could take months and might not guarantee a refund.

Consumers are also feeling immediate tariff consequences

While businesses are bearing the brunt of upfront costs, consumers are beginning to feel the impact.

One customer shared a screenshot showing the Radxa Orion O6, which was $300 in December but has surged to $1,500, a fivefold price increase.

Rising retail prices show companies passing costs to buyers, increasing fears of ongoing inflation growth.

Economic analysts have warned that the true cost of the tariffs will become more evident in the coming months.

As companies struggle with import fees and disrupted supply chains, more industries expected to increase prices or cut services.

The situation has sparked heated debate among policymakers and the public, with critics accusing Trump of reckless economic strategy and supporters defending the move as a necessary step to protect American industries.