Parents sparked controversy when they openly boasted about spending all of their adult children’s inheritance.

Parents used the money on lavish overseas holidays.

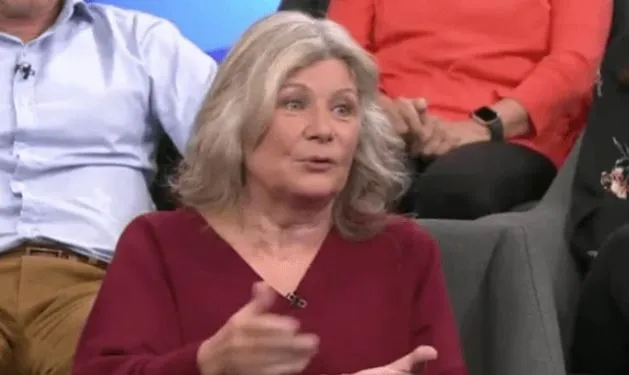

In an interview on the SBS Insight program, the couple proudly described their travels to numerous luxury destinations around the world.

They admitted to using up the money that was meant to be passed down to their offspring.

Leanne and Leon Ryland are a married couple from Victoria, Australia.

They have two adult sons. Before retiring 4 years ago, the Rylands got advice from a financial planner.

The planner told them they had saved and invested wisely in property and retirement funds.

Parents plan to spend their retirement funds on luxury overseas travels.

Therefore, he suggested they retire early. He said they would likely spend a lot of their savings on travel and fun in the first 10 years, then spend less.

“Now we’re in a phase where we’re spending rather than saving,” Ms. Ryland explained.

Since retiring, the couple has taken many luxury holidays and cruises. They have spent $170,000 visiting places like Machu Picchu in Peru and traveling to India, Sri Lanka, and the Maldives. They plan to go to the US next month.

Leanne Ryland explained that she keeps telling her husband they should enjoy their money now, rather than waiting. She said their son will eventually get the money.

“I keep telling [my husband] we should enjoy our money now, because otherwise, who will? Our son will get it eventually,” Ms. Ryland said.

The couple is part of a private Facebook group called ‘SKIclub’ (Spending Kids’ Inheritance), where they share travel advice with other wealthy retirees.

Their son Alex supports their decisions, saying they worked hard and deserve to be happy.

‘It’s their money,’

‘They’ve worked hard their entire life and invested well in order to get that money so I think they should be able to do whatever they’d like with it,’ Alex said.

On social media, people are divided by Ryland’s approach to his wealth.

Children do not deserve to inherit anything from their parents. The new entitled generation spend all their money on overseas trips, experiences and luxuries, expecting to inherit a house and money from their parents who worked hard and lived frugally to pay off a house and provide for their children and their education. Parents have provided enough, one user said.

Children do not have a right to an inheritance from their parents, Nor should they begrudge them spending some or all of their income/savings and equity from a property on themselves during their retirement, the second user commented.

Not really entitlement. They earned the $. The inheritance is whatever is left over, the third user supposed.

Most kids are just grateful if their parents are able to support themselves and don’t require their kids to help, another wrote.

They’re so selfish, someone wrote.

How they can spend all of their kids’ inheritance on luxury travel? It makes no sense, another commented.

What will they leave for their kids after that? Maybe a debt? another wrote.

In a similar case, Ashton Kutcher and Mila Kunis have stirred up controversy with their decision.

They announced that they will not leave any inheritance money for their children.

Despite their combined wealth of around $275 million, the famous couple plans to donate their fortune to charity and other causes instead.

In a 2018 interview, Kutcher explained that they do not want to set up trust funds for their kids, but they would be willing to invest in their children’s business ventures, as long as they have a solid business plan.

Kutcher and Kunis’ decision continues to generate mixed reactions on social media. Some applaud the plan, seeing it as a way to instill a sense of responsibility in their children and prevent them from becoming spoiled.

However, others criticize the decision, arguing that they should leave their assets for meaningful purposes while still ensuring their children’s financial security.

Kunis also shared that she wants to make sure her children don’t become wasteful or spoiled, despite being raised in extraordinary circumstances.

The couple even implemented a “no gifts” policy for Christmas when the kids were young, instead requesting charitable donations or allowing only one gift from the grandparents.