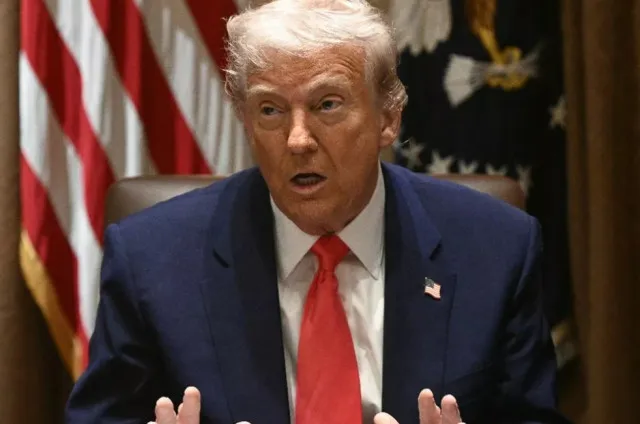

Donald Trump claims he can finalize all global trade deals in just one day, drawing global attention and widespread skepticism.

President Donald Trump recently made headlines with his bold claim that he could finalize global trade deals in just one day.

This statement comes as the world watches closely to see how the United States will navigate its trade relationships, especially with major economies like China.

Recent tariff changes impact global trade and economies.

Trump’s remarks follow a significant shift in U.S. trade policy.

Recently, he announced a temporary pause on high tariffs affecting 75 countries. This pause caused a surge in stock markets as investors reacted positively to the news.

However, critics argue that Trump’s decision was more about responding to pressure than a well-planned strategy.

Despite the pause, the U.S. has increased tariffs on Chinese imports.

Reports indicate that tariffs on China could be as high as 145%, a move intended to combat issues like the flow of fentanyl into the U.S. These changes have left many wondering what the future holds for international trade.

Trump vows to clinch global trade deals in just one day after 90-day tariff pause

Trump’s announcements have created a sense of confusion. Just hours after announcing the tariff pause, he took to social media to express optimism about the future, stating, “What a day, but more great days coming!”

This mixed messaging has left many unsure about the administration’s true intentions regarding trade.

In the UK, officials are keeping a close eye on these developments. Home Secretary Yvette Cooper urged caution, citing ongoing global instability. She emphasized the need for the UK to adapt to changing economic conditions and to remain proactive in trade discussions.

Economic impacts of tariff policies

The financial community is deeply concerned about the implications of Trump’s tariff policies. Experts suggest that the recent fluctuations in the stock market are partly due to fears of rising U.S. borrowing costs.

If tariffs continue to rise, they could significantly impact the economy, leading to potential recessions.

The yield on U.S. Treasury bonds rose sharply, indicating that investors are wary of the economic fallout from these trade policies.

This situation has drawn parallels to previous political and economic crises, highlighting the fragile state of global markets.

Trump’s relationship with China

Despite the tension surrounding tariffs, Trump has expressed a desire for positive relations with China.

He referred to Chinese President Xi Jinping as a “friend” and suggested that a trade deal beneficial for both nations is within reach.

Trump’s confidence in securing deals quickly is part of his broader strategy to reshape international trade agreements.

“All we are doing is putting it back in shape and resetting the table and I am sure we will get along very well. I have great respect for President Xi.

He has been a friend of mine for a long period of time. I think we will end up working out something that is good for both countries.”

During a press conference, he stated that he could finalize deals with other countries in just one day, asserting that he aims to create agreements that are fair and beneficial.

However, he also warned that tariffs would be reinstated if negotiations do not yield satisfactory results.

“I could make very deal in one day,” he declared, adding: “I could do this all in one day.” But went he went on: “We want to make a deal that is proper.”

“That is want will happen if we can’t make the deal that we want to make,” he said, adding. “It has to be good for both parties.”

Investors and analysts react to changing trade policies.

Reactions from investors and analysts have been mixed. Some believe that the immediate risk has decreased, but uncertainty remains a significant concern.

As markets continue to react to Trump’s statements and actions, many are left wondering how long this period of volatility will last.

David Morrison, an analyst, commented on the situation, saying that while the danger may be less pressing, the underlying uncertainties are still present.

Investors are closely monitoring the situation, hoping for clearer guidance from the U.S. government.

“The immediate danger is over. But investors are… keenly aware that uncertainty still shrouds the markets.”