A woman is angry after a $2k charge from Starbucks appears on her credit card even though she doesn’t drink coffee.

A woman from Colorado was left furious after discovering a staggering charge of over $2,000 on her credit card from Starbucks.

Lisa Schwartz, who claims she does not even drink coffee, was baffled by this unexpected expense.

The incident has raised questions about security and the risks of automatic payment systems.

Woman outraged after Starbucks charges her $2K on credit card despite not drinking coffee

Lisa noticed the charges while reviewing her American Express bill.

She uses an auto-reload feature linked to her Starbucks app, which allows her to automatically add funds to her account when the balance runs low.

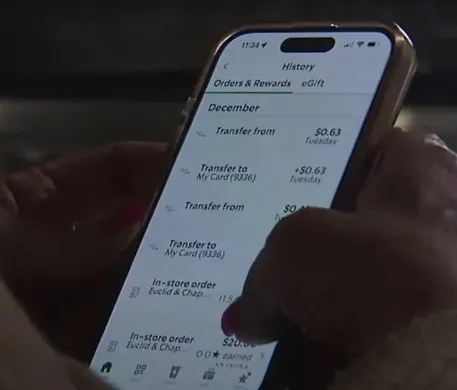

Typically, she sets this amount to $25. However, when she checked her account, she was shocked to find multiple transactions totaling well over $2,000.

“It’s kind of a sick feeling,” Lisa expressed. “I felt pretty stupid for not watching my bills more closely.”

She mentioned that she usually orders chai lattes, not coffee, making the charges even more confusing.

Lisa began investigating after noticing suspicious activity on accounts.

After spotting the strange charges, Lisa began her investigation.

She believed her account may have been hacked.

Reports indicated that funds were being transferred to her Starbucks app several times a day, which raised her suspicions.

Receipts showed purchases made at Starbucks locations far from her home, even as far away as California.

Frustrated, Lisa reached out to Starbucks for help.

A cybersecurity expert informed KMGH that Starbucks itself was not hacked; instead, someone obtained Schwartz’s login details.

He cautioned that if she reused usernames or passwords, the hacker could potentially access her other accounts.

After her experience, Schwartz advised others to be vigilant about the apps where they input their credit card information.

Amid the confusion, Lisa was temporarily credited $550 while the investigation continued.

She received a letter stating that if she did not hear back by February 16, she could assume the issue was resolved.

However, the uncertainty surrounding her finances remained troubling.

“I don’t want other people to have this happen to them,” Lisa warned.

She hopes that by sharing her experience, others will be more cautious about their online accounts and payment methods.

Cybersecurity plays a crucial role in protecting accounts.

Experts suggest that incidents like Lisa’s are becoming more common as cybercriminals develop new tactics.

A cybersecurity expert explained that Starbucks itself did not suffer a breach; rather, someone likely gained access to Lisa’s account information.

This could happen if she used the same username and password across different sites, putting her other accounts at risk as well.

The expert emphasized the importance of using unique passwords for each account to safeguard personal information.

Strong passwords that combine letters, numbers, and special characters are harder for hackers to guess.

Tips for protecting yourself

To avoid falling victim to similar situations, experts recommend several strategies.

First, always monitor your financial statements closely. Look for any transactions that seem unusual or unfamiliar.

If you spot any, act quickly to address them.

Second, consider using two-factor authentication on your accounts.

This adds an extra layer of security by requiring a second form of identification before accessing your account.

Additionally, be wary of online deals that seem too good to be true.

Scammers often use attractive offers to lure people into providing personal information.

Always verify the source of any communication that requests your account details.