Trump’s new tariffs raise doubts in Germany about storing $96B in gold at the New York Fed.

Germany’s gold reserve strategy faces new risks amid US tariff escalation

Tensions between the United States and its allies are rising as former President Donald Trump’s tariff policies continue to stir global uncertainty.

At the heart of this conflict is a striking symbol of economic trust: Germany’s gold reserves in New York.

Valued at an estimated €113 billion (around $96 billion), these reserves are now the subject of renewed debate in Berlin.

Germany, which holds the world’s second-largest national gold reserve, has traditionally stored a large portion—about 37 percent or 1,236 metric tons—of its gold in the secure vaults of the Federal Reserve Bank of New York.

Trump’s unpredictable economic moves, especially the imposition of tariffs on European goods, have shaken Germany’s confidence.

As a result, the long-standing alliance between the two countries has been put under strain.

Trump’s tariffs on the european union rekindle old fears in Germany

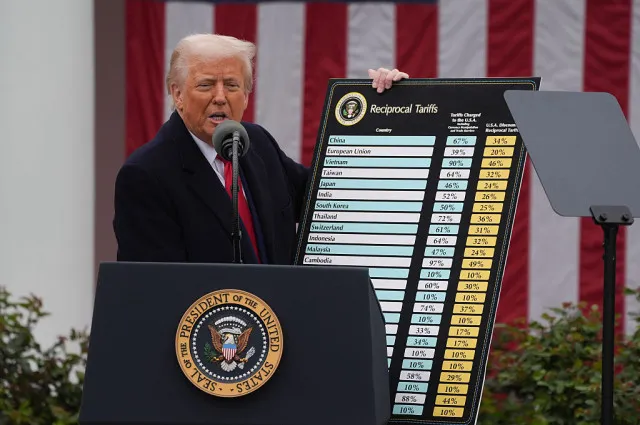

On April 2, a date some in Germany refer to as “Liberation Day,” Trump announced sweeping new duties targeting global trade partners.

This included a 20 percent tariff on products from the European Union and a separate 25 percent tariff on imported vehicles.

These aggressive measures have reignited tensions between the U.S.

The EU and brought back old fears in Berlin about the risks of overreliance on a single foreign partner.

The trade war between the U.S. and China has already destabilized global markets. Now Europe, a long-time ally of Washington, finds itself on edge.

Senior german officials question the reliability of storing gold in the US

The gold stored in New York represents more than just financial value; it stands for decades of transatlantic trust and cooperation.

But that trust is being tested.

According to Bild, a leading German newspaper, influential figures within the conservative Christian Democratic Union (CDU) are actively discussing the possibility of repatriating Germany’s gold from U.S. soil.

Marco Wanderwitz, a former German government minister and member of the CDU, acknowledged growing concerns: “Of course, the question has arisen again,” he told Bild.

Additionally, Wanderwitz has long advocated for increased oversight of Germany’s foreign-held reserves.

In 2012, he attempted to personally inspect the gold in New York—a request that was ultimately denied.

The call for transparency is echoed by Markus Ferber, a member of the European Parliament also from the CDU.

“I demand regular checks of Germany’s gold reserves. Official representatives of the Bundesbank must personally count the bars and document their results,” Ferber stated.

The strategic value of gold in foreign vaults is being reconsidered

Germany’s decision to store a large share of its gold abroad was initially rooted in Cold War-era strategy.

Storing gold in global financial hubs like New York ensured access to stable markets and quick liquidity in case of geopolitical emergencies.

However, with shifting international dynamics, the Bundesbank has already begun to reassess this policy.

In recent years, Germany has quietly repatriated some of its gold reserves from Paris and New York, citing logistical and political concerns.

Trump’s latest actions may be pushing other countries to fully re-evaluate whether they can continue to trust the U.S. as a safe custodian.

As trade disputes deepen and diplomatic relationships fray, the possibility of Germany removing its gold from the New York Federal Reserve is gaining traction.