Haliey Welch, famously known as Hawk Tuah Girl, is under scrutiny following the launch of her cryptocurrency, HAWK.

Investors allege significant losses, prompting law firms to investigate potential legal action. Welch’s coin, initially hailed as a way to connect with fans, has left many feeling betrayed.

HAWK Coin launch promised connection, ended in controversy

On December 4, Haliey Welch launched her cryptocurrency, HAWK, promising it was “not just a cash grab.” In an interview with Fortune, her manager Jonnie Forster described the initiative as “tokenizing Haliey’s fan base.”

The project quickly gained traction, with the coin’s market capitalization reaching nearly $500 million shortly after its debut.

However, within 20 minutes, HAWK’s value plummeted dramatically from $490 million to just $41 million.

The sudden drop left fans and investors outraged, with some claiming to have lost their life savings.

Fans report financial losses amid allegations of a ‘rug pull’

Investors voiced their frustration across social media, with one fan stating they had used their life savings and their children’s college fund to purchase the coin.

Many accused Welch of a “rug pull,” a term used when creators abandon a cryptocurrency project after profiting from initial investments.

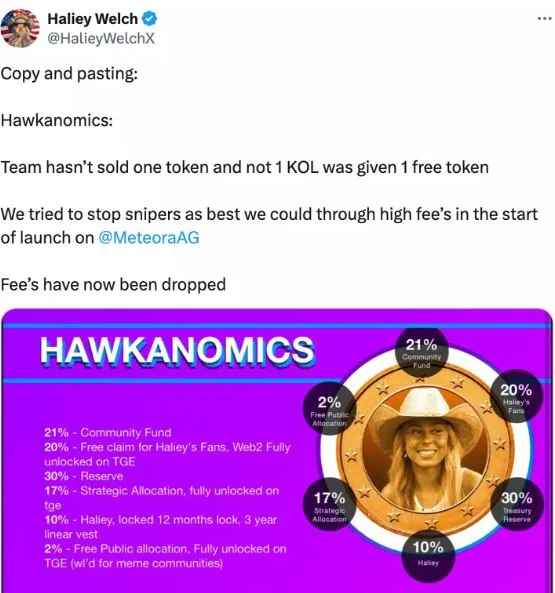

Despite the backlash, Welch defended the launch. On Twitter, she claimed her team hadn’t sold any tokens and implemented high transaction fees to deter early market manipulation.

Law firms step in to investigate investor claims

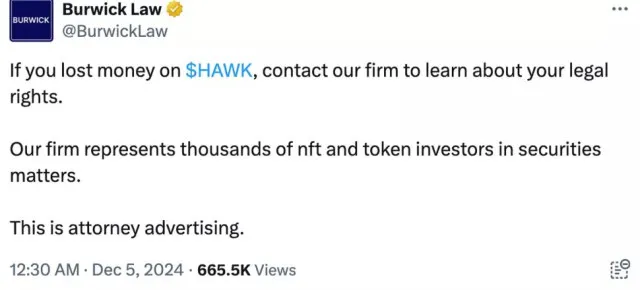

The controversy has drawn the attention of law firms like Burwick Law in New York. The firm, known for representing investors in NFT and token-related cases, is urging HAWK investors to explore their legal options.

Burwick Law emphasized the disparity between celebrity gains and investor losses, stating, “While everyday people take losses, celebrities walk away richer. We’re here to help bring accountability to a space that desperately needs it.”

In a Twitter post directed at HAWK investors, the firm encouraged those affected to contact them for legal assistance, signaling the potential for broader legal challenges.

Haliey Welch’s stance amid growing criticism

In the wake of the coin’s collapse, Welch maintained that the project was not a cash grab. She expressed her commitment to using cryptocurrency as a way to connect with her fans.

However, the rapid devaluation of HAWK and ensuing legal scrutiny have cast a shadow over her intentions.

The HAWK coin controversy highlights the risks of investing in celebrity-backed cryptocurrency ventures.

While Welch’s intentions may have been genuine, the fallout underscores the need for transparency and investor caution in the volatile world of digital assets.

As investigations continue, the incident serves as a reminder for investors to thoroughly vet projects and approach such opportunities with skepticism.