A recent report from Yale University has shown the potential impact of Donald Trump’s ‘Liberation Day’ tariffs on the average annual expenses of US households.

Trump reignites the trade war

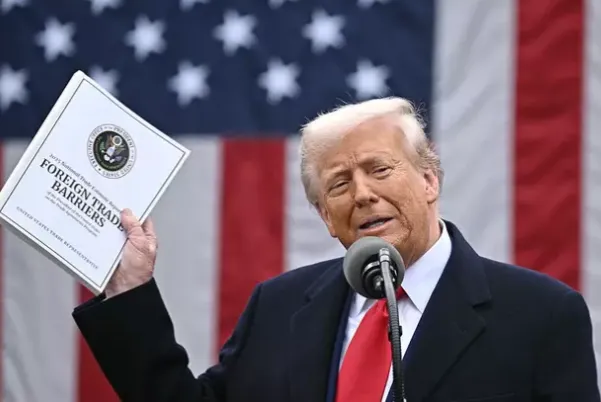

On April 2, Donald Trump stood in the White House Rose Garden and announced a fresh wave of tariffs, targeting countries like Germany, Brazil, and Colombia.

Behind him, large boards detailed which nations would face new charges and by how much.

Trump framed these tariffs as a bold move to address the “national emergency” of America’s trade deficit.

But beneath the political rhetoric, millions of U.S. households now face a more personal challenge—higher living costs.

Tariffs push U.S. rates to historic highs

A report from Yale’s Budget Lab shows the average effective U.S. tariff rate has surged to 22.5% in 2025, the highest since 1909.

These steep rates directly raise the prices of everyday items, including:

-

Coffee

-

Alcohol

-

Automobiles

Consumers won’t just pay more for select products—they’ll feel the squeeze across their entire budget.

Tariffs take a direct toll on household budgets

The report estimates a 2.3 percentage point increase in overall inflation, resulting in an extra $3,800 per year in expenses for the average American household.

Families with lower incomes face an estimated $1,700 increase, deepening financial strain.

Bill Adams, chief economist at Comerica Bank, emphasized that businesses are likely to pass these added costs directly to consumers.

“Even if foreign suppliers absorb some of the costs, Americans will likely see a 3–5% cumulative price increase above the typical inflation rate,” he told The New York Post.

Some industries may adapt

Not every sector plans to pass costs to consumers. Brandon Daniels, CEO of AI supply chain firm Exiger, believes industries such as furniture, textiles, and appliances could respond by shifting production back to the U.S.

“Industries with more flexible manufacturing models have historically reshored or diversified their supply chains to deal with rising costs,” Daniels explained.

However, such changes take time—and may not come fast enough to shield consumers from short-term price hikes.

Recession fears on the horizon

Just one day after the tariff announcement, JPMorgan warned that the U.S. economy could slide into a recession if Trump’s tariff policy stays in place.

The financial sector responded swiftly, underlining broader concerns about potential macroeconomic fallout.

Tariffs come at a steep price

Trump’s tariffs may aim to fix America’s trade imbalance, but the cost won’t fall solely on foreign exporters.

With inflation rising and essentials becoming more expensive, American families could bear the brunt of these policies.

For most households, the impact won’t show up in trade stats—it will hit them right at the checkout counter.