Global Stock Market in Turmoil Due to Trump’s Tariffs

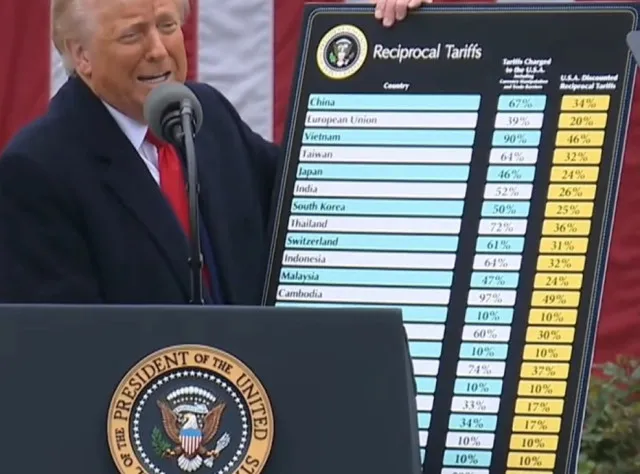

Last week, US President Donald Trump announced sweeping and aggressive tariffs on almost every country, sending shockwaves through the global financial markets. Stock prices plunged across the board as investors rushed to sell off their assets and convert them back into cash, causing market values to drop even further.

On April 3rd and 4th, the US stock market experienced its worst two-day loss in history, wiping out around $6.6 trillion in market capitalization. This financial disaster did not only impact the US — European and Asian stock markets also suffered heavy losses. The UK’s FTSE 100 dropped to its lowest level in a year, while Asian markets faced what was described as “two terrible days combined.”

Even cryptocurrencies were not spared, with Bitcoin falling sharply and erasing most of its gains since Trump’s election victory last year.

Serious Impact on the Global Economy and Growing Recession Fears

The ongoing “bloodbath” in the stock markets raises growing concerns about a potential global recession. JP Morgan increased its global recession risk forecast to 60%, while Goldman Sachs raised theirs to 45% within just a week.

Oil prices continue to fall, which may help drivers save a little at the pump. However, rising business expenses from tariffs will likely push up the prices of many consumer goods.

Investors are losing confidence, and uncertainty about the market’s future remains high. Pension funds hold large amounts of stock investments, so recent losses could affect millions of people who don’t trade stocks directly but rely on pension schemes for their future savings.

An Uncertain Future: What Lies Ahead?

There was brief hope when rumors spread that Trump might delay the tariffs for 90 days, causing a temporary rebound in the markets. However, when the White House denied this, stock prices continued their downward spiral.

So far, Warren Buffett is the only billionaire in the world’s top 500 who hasn’t lost money, thanks to his decision to sell US stocks early after Trump returned to office.

Experts believe that market volatility will continue for some time, and a full recovery could take months — or even longer. The risk of a global recession remains real, and companies may resort to cutting jobs or freezing hiring as they brace for challenging times ahead.

Meanwhile, some investors see this as a chance to “buy the dip” — purchasing stocks at their lowest prices in hopes of selling them for profit when the market recovers. However, with current levels of uncertainty, this strategy carries significant risks.