In the interview with Sydney on the street, a woman left viewers stunned after the publication of the Australian housing market.

A young woman's frustration with the Australian property market has highlighted the challenges faced by aspiring homeowners, despite significant savings.

At just 30 years old, she shared her story in a TikTok video, lamenting that her $95,000 in savings still falls short of enabling her to purchase a suitable property in Sydney.

The reality of high property prices on Sydney.

Sydney's median house price stands at a staggering $1.442 million, necessitating a deposit of $288,391 for a 20% down payment alone. Even with such savings, she emphasized the difficulty of securing a mortgage, particularly for single individuals who are not high-income earners.

She critiqued the prevailing belief that hard work and diligent savings guarantee entry into the property market, calling it a "lie." Despite her efforts, she finds herself priced out of the market, echoing sentiments shared by many facing similar circumstances.

Strategic decision in pursuit of homeownership

Facing the daunting reality of current housing prices, she has opted to delay her property purchase plans. Instead, she plans to invest in further education, hoping to enhance her career prospects and financial stability within the next five years.

This decision reflects a pragmatic approach to improving her earning potential amidst challenging economic conditions.

The video quickly went viral and sparked debate on social media.

One person said: she's obviously looked into it, asked the banks and it's unattainable.

A second wrote: 100k in savings isn't a small amount, house prices are not coming down; buy what you can now - you'll never be able to save at the rate property goes up!

While a third commented: Crazy, almost 8 years ago now my partner and I had $30k together and we were able to buy land and build a house with that!

Someone else said: Buy an investment property first get your home later

Another user added: Deposit isn’t the issue, it’s the repayments. Single person can’t afford the repayments even if they have enough for a deposit.

This is not the first time there have been discussions on economic inequality and housing affordability.

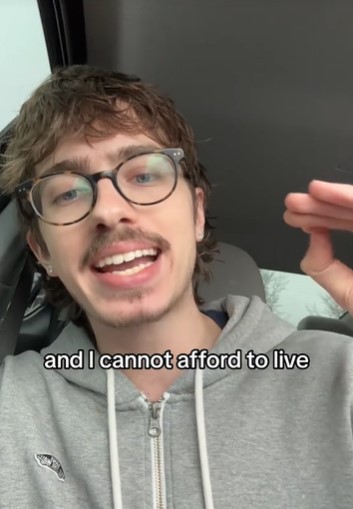

Previously, on TikTok platform, a man left viewers stunned after revealing he couldn't live despite earning three times the federal minimum wage.

In viral video on TikTok, a user, who goes by @nicsmnrs shared similar frustrations. Sumners, despite earning well above the minimum wage, highlight the stark contrast between current living costs and past generational standards.

Despite earning over three times the minimum wage, Sumners claimed that the "American Dream is dead." Earning around $22 per hour, or $3,520 a month, he found it impossible to afford living alone, with one-bedroom apartments costing $1,800 and two-bedroom units at $2,200.

In the footnote, Sumners also admitted the stark contrast between his financial situation and that of his parents. He pointed out that his parents were able to live alone at his age, earning ‘less than half’ of what he makes now.

He shared his frustration in a viral video, stating, “I cannot afford to live anywhere alone,” despite earning around $22 per hour, or $3,520 a month working 40-hour weeks."

The narratives shared by individuals like the young woman in Sydney and Nicholas Sumners underscore deep-seated issues in housing affordability and economic disparity.

What did you think about this incident?